In the competitive world of mortgage advising in New Zealand, effective digital marketing is key to standing out and attracting clients. Whether you’re an independent advisor or part of a larger firm, harnessing the power of digital marketing can significantly boost your visibility, build trust with potential clients, and ultimately grow your business. This guide will walk you through the essential strategies to implement for successful digital marketing as a mortgage advisor in New Zealand.

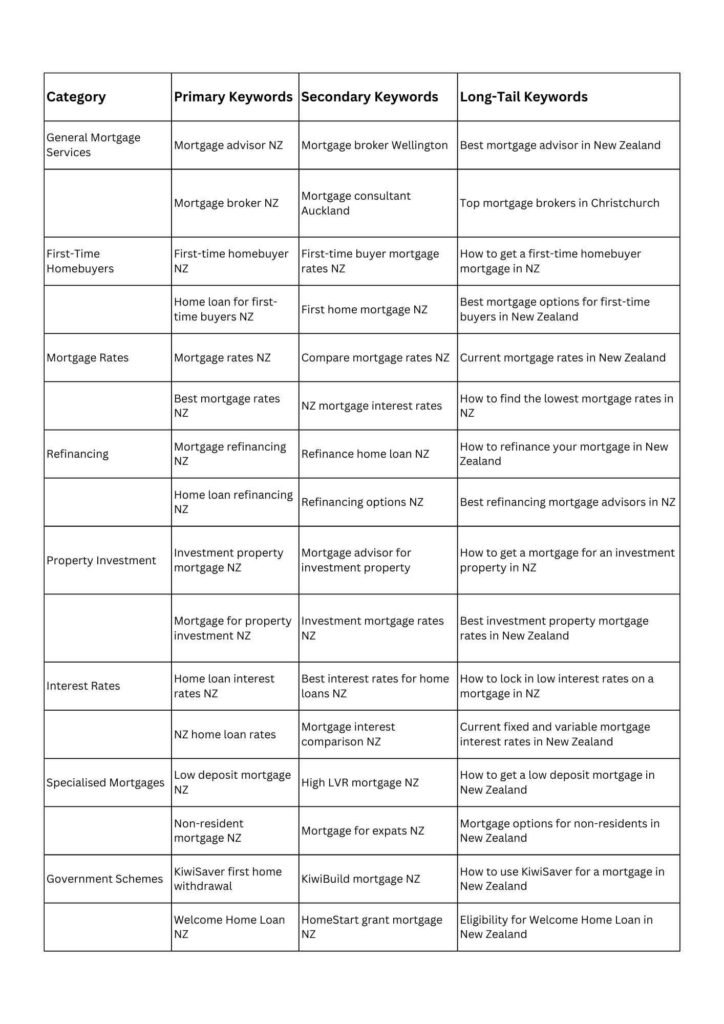

1. Search Engine Optimisation (SEO)

SEO is the foundation of your online presence. By optimising your website for search engines, you increase the chances of potential clients finding you when they search for mortgage-related services.

- Local SEO: Focus on keywords that are specific to your location, such as “mortgage advisor Auckland” or “best mortgage rates in Wellington.” This ensures that people in your area find your services easily.

- Content Creation: Regularly update your website with informative content, such as blog posts about the mortgage process, tips for first-time homebuyers, or explanations of different mortgage types available in New Zealand. This not only improves your SEO but also positions you as an expert in the field.

- On-Page Optimisation: Make sure that your website is mobile-friendly, has fast loading times, and includes meta tags, headers, and URLs optimised with relevant keywords.

2. Pay-Per-Click Advertising (PPC)

PPC advertising allows you to gain immediate visibility in search engine results. For mortgage advisors, Google Ads is particularly effective.

- Targeted Keywords: Use highly relevant keywords in your PPC campaigns, such as “best mortgage rates NZ” or “home loan advisor Auckland.” This will ensure that your ads are shown to users who are actively searching for mortgage services.

- Geographical Targeting: Focus your ads on specific regions or cities where you operate. This is especially important if your services are location-specific.

- Ad Extensions: Use ad extensions to include additional information, such as your phone number, a link to your website, or customer reviews. This can increase the effectiveness of your ads by providing more reasons for users to click through.

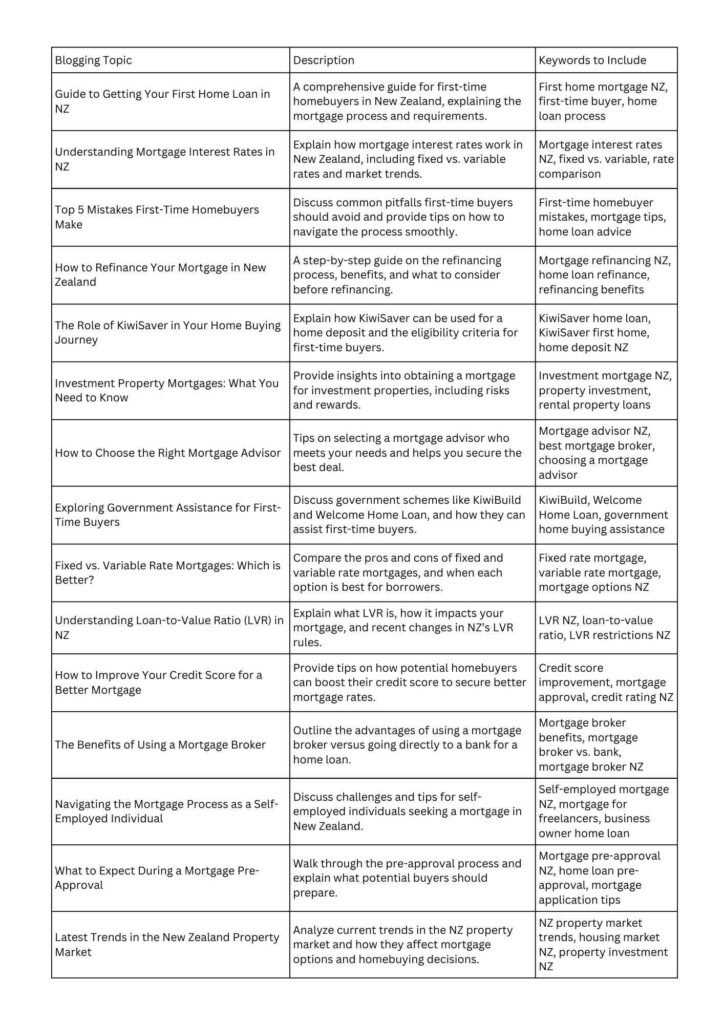

3. Content Marketing

Content marketing is a powerful tool for mortgage advisors. It helps you build trust with potential clients by providing them with valuable information that answers their questions and addresses their concerns.

- Blogging: Start a blog on your website where you regularly post articles about the mortgage industry, tips for securing the best mortgage rates, and updates on market trends in New Zealand.

- Case Studies: Share success stories of clients you’ve helped secure favorable mortgage rates. Case studies are a great way to showcase your expertise and build credibility.

- Video Content: Create short videos explaining the mortgage process, different types of loans, and other relevant topics. Videos are highly engaging and can be shared across multiple platforms.

- Guides and Ebooks: Offer downloadable guides or ebooks on topics like “Understanding the NZ Mortgage Market” or “Tips for First-Time Homebuyers in New Zealand.” These can be used as lead magnets to grow your email list.

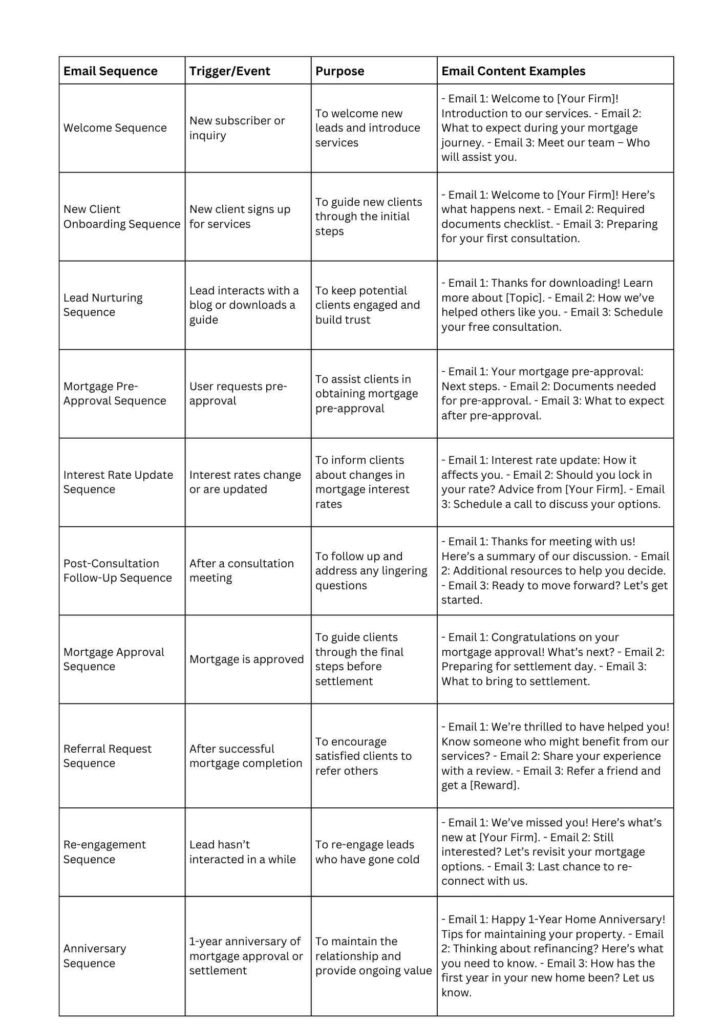

4. Email Marketing

Email marketing allows you to stay in touch with potential clients, nurture leads, and keep your audience informed about your services.

- Newsletter Campaigns: Send regular newsletters that include updates on mortgage rates, industry news, and tips for homeowners. Make sure to personalise these emails based on the recipient’s interests and needs.

- Automated Email Sequences: Set up automated email sequences for different stages of the client journey. For example, send a welcome email to new subscribers, followed by a series of emails that educate them about the mortgage process and encourage them to schedule a consultation.

- Lead Magnets: Use lead magnets like free mortgage calculators or downloadable guides to collect email addresses from website visitors. This helps you build a list of potential clients that you can nurture over time.

5. Social Media Marketing

Social media platforms are an excellent way to engage with your audience, share valuable content, and promote your services.

- Platform Selection: Focus on platforms like Facebook, LinkedIn, and Instagram, where you can connect with potential clients and share content that demonstrates your expertise.

- Targeted Ads: Use social media ads to target specific demographics, such as first-time homebuyers or people looking to refinance their mortgage. You can also use lookalike audiences to reach people who are similar to your existing clients.

- Engagement: Regularly post updates, share industry news, and engage with your followers by responding to comments and messages. This helps build a community around your brand and keeps your audience engaged.

- Content Sharing: Share your blog posts, videos, and case studies on social media to reach a wider audience. You can also create infographics that simplify complex mortgage concepts and share them on platforms like Instagram and Pinterest.

6. Google Business Profile

A well-optimised Google Business Profile is essential for local SEO and helps your business appear in local search results and on Google Maps.

- Complete Your Profile: Make sure all your business information is complete and accurate, including your address, phone number, business hours, and website link.

- Client Reviews: Encourage satisfied clients to leave positive reviews on your Google Business Profile. Respond to all reviews, thanking those who leave positive feedback and addressing any concerns raised in negative reviews.

- Post Updates: Use the post feature to share updates, such as new blog posts, upcoming webinars, or changes in mortgage rates.

- Photos and Videos: Upload high-quality photos and videos that showcase your office, team, and any awards or certifications you’ve received.

7. Web Design and User Experience

Your website is often the first point of contact potential clients have with your business, so it’s important that it makes a strong impression.

- Service-Specific Pages: Create dedicated pages for each service you offer, such as “First-Time Homebuyer Mortgages,” “Refinancing Options,” and “Investment Property Loans.” Each page should be optimised for relevant keywords and provide detailed information about the service.

- Clear CTAs: Make sure each page has a clear call to action (CTA), such as “Request a Free Consultation” or “Get Pre-Approved Today.” This guides visitors toward taking the next step.

- Mobile Optimisation: Ensure your website is mobile-friendly, as many users will access your site from their smartphones. A mobile-optimised site improves user experience and helps with SEO.

- Trust Signals: Include testimonials, certifications, and trust badges on your website to reassure potential clients of your credibility and expertise.

8. Video Marketing

Video marketing is a highly engaging way to communicate complex mortgage concepts and build trust with potential clients.

- Explainer Videos: Create short explainer videos that break down the mortgage process, different types of loans, and other key topics. These videos can be featured on your website, YouTube channel, and social media platforms.

- Client Testimonials: Video testimonials from satisfied clients are powerful tools for building trust. These can be shared on your website and social media to showcase your success stories.

- Live Q&A Sessions: Host live Q&A sessions on platforms like Facebook or Instagram where potential clients can ask questions about the mortgage process. This interactive format helps build rapport and provides immediate value to your audience.

- Webinars: Offer free webinars on topics like “Understanding NZ Mortgage Rates” or “How to Secure the Best Home Loan.” Webinars position you as an expert and allow you to engage with potential clients in real time.

Conclusion

Digital marketing is essential for mortgage advisors looking to thrive in New Zealand’s competitive market. By implementing these strategies—SEO, PPC, content marketing, email marketing, social media, Google Business Profile optimisation, web design, and video marketing—you can increase your visibility, build trust with potential clients, and grow your business. Whether you’re just starting out or looking to expand your client base, these digital marketing tactics will help you achieve your goals.